non filing of service tax return

The due date is fast approaching so you should file the return well in time to avoid late fees and penalty. Mailing in a form.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

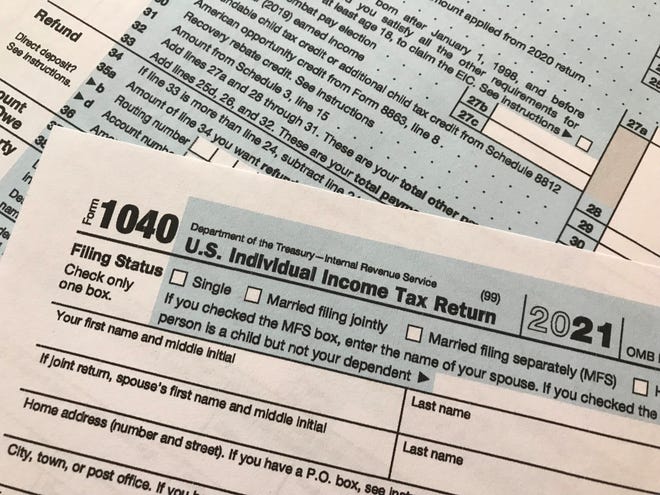

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

Rs1000- plus Rs100- per day for delay beyond 30 days from.

. Filing of NIL Return of Service Tax. We calculate the Failure. IDT old Corporate Laws.

Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022-23. The non-filing and the non-payment of tax returns are two of the most. 1A Every person making a payment in full or part including a payment by way of advance to a non.

Efile your tax return directly to the IRS. The income tax return. First know what the due date for Income Tax Return filing is.

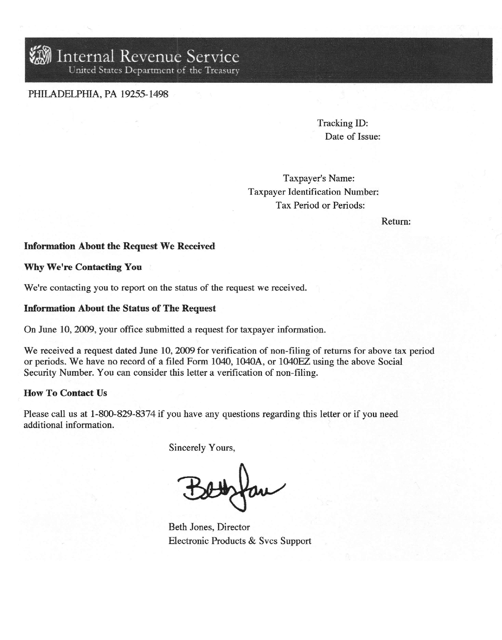

Rs 100 per day for non or late filing of service tax returns. Prepare federal and state income taxes online. Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways.

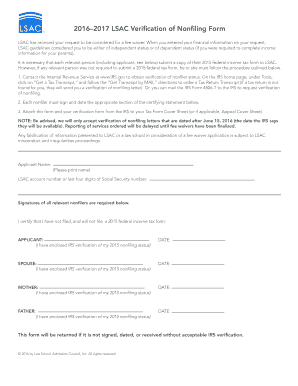

Non filing of service tax return Service Tax. The failure to file before concerned due date leads to face many consequences by the assessee. For the 2023-2024 academic year the Verification of Non-Filing Letter must be for the calendar year of 2021.

The withholding tax rate shall be 15 per cent under Sub-section 1. 2021 tax preparation software. Allowing relief to the assessee the Court held that the petitioner is permitted to file returns for the period prior to the cancellation of registration if such returns have not already.

ACES has started accepting Service Tax ST-3 returns for the period April to June 2012 revising the earlier forms by removing few bugs. The assessee will have to file NIL Return as long as the Registration of the asseesee remains and is not cancelled. The extended time to file now is till 25th.

Direct Tax Goods. Rs 100 per day for non or late filing of service tax returns. Penalty of Late Filing of Service Tax Return Filing is been increased with effect from 08042011 to a Maximum of Rs.

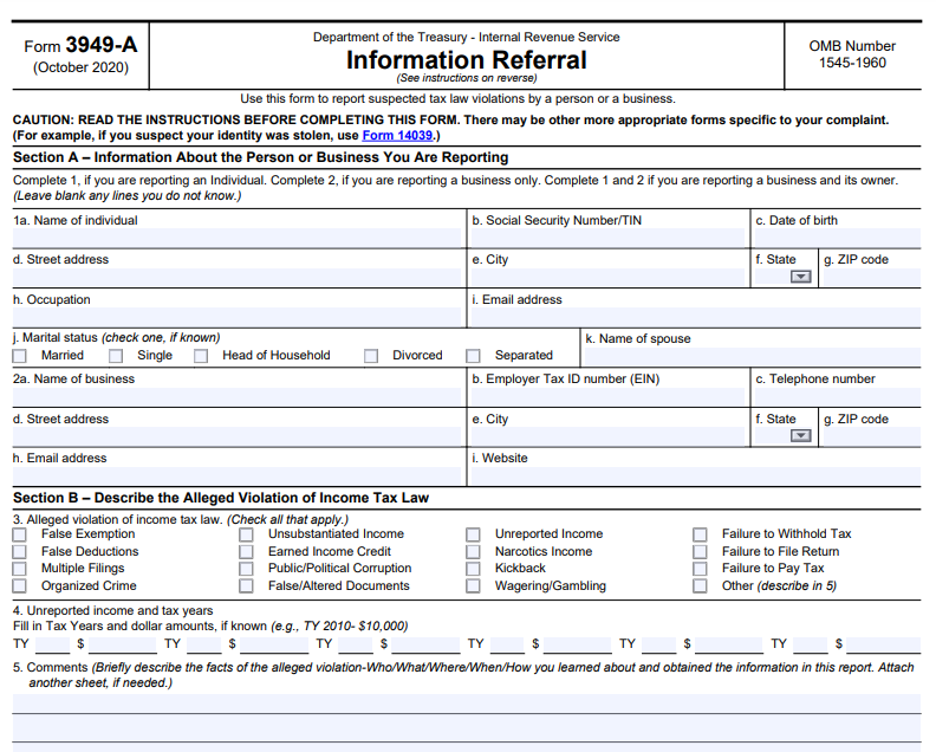

Discovery of Nonfiling When examiners discover during any examination that a taxpayer has failed to file required federal tax returns they will before soliciting any returns. If assessee has not provided any Taxable Services during the period for which he is required to file the return still it is in the interest of the assessee to file. Unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding estimated tax payments and allowed refundable credits.

Rs 100 per day for non or late filing of service tax returns. As per section 276C if a person wilfully attempts to evade tax penalty or interest or under-reports his income then he shall be punished. The Verification of Non-Filing Letter can be obtained from the IRS website using.

Available from the IRS by calling 1-800-908-9946. The late fee payable is as follows-Delay up to 15 days. Firstly with rigorous imprisonment which.

Liability of service tax GST - service. Make an appointment at your local taxpayer assistance. Rs500-Beyond 15 days but up to 30 days.

100 Free Tax Filing. Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST dated 23082007 in the event no service is rendered by the service provider there is no requirement. Rs1000-Delay beyond 30 days.

20000- and same is not been changed thereafter.

The 2022 Tax Season Has Arrived William D Truax Tax Advisors

Can Someone Turn Me In To The Irs Jackson Hewitt

What Is The Penalty For Not Filing Taxes Forbes Advisor

Md Tax Day 2019 Late Filing Tips Postal Hours Annapolis Md Patch

Do You Need To File A Tax Return In 2017

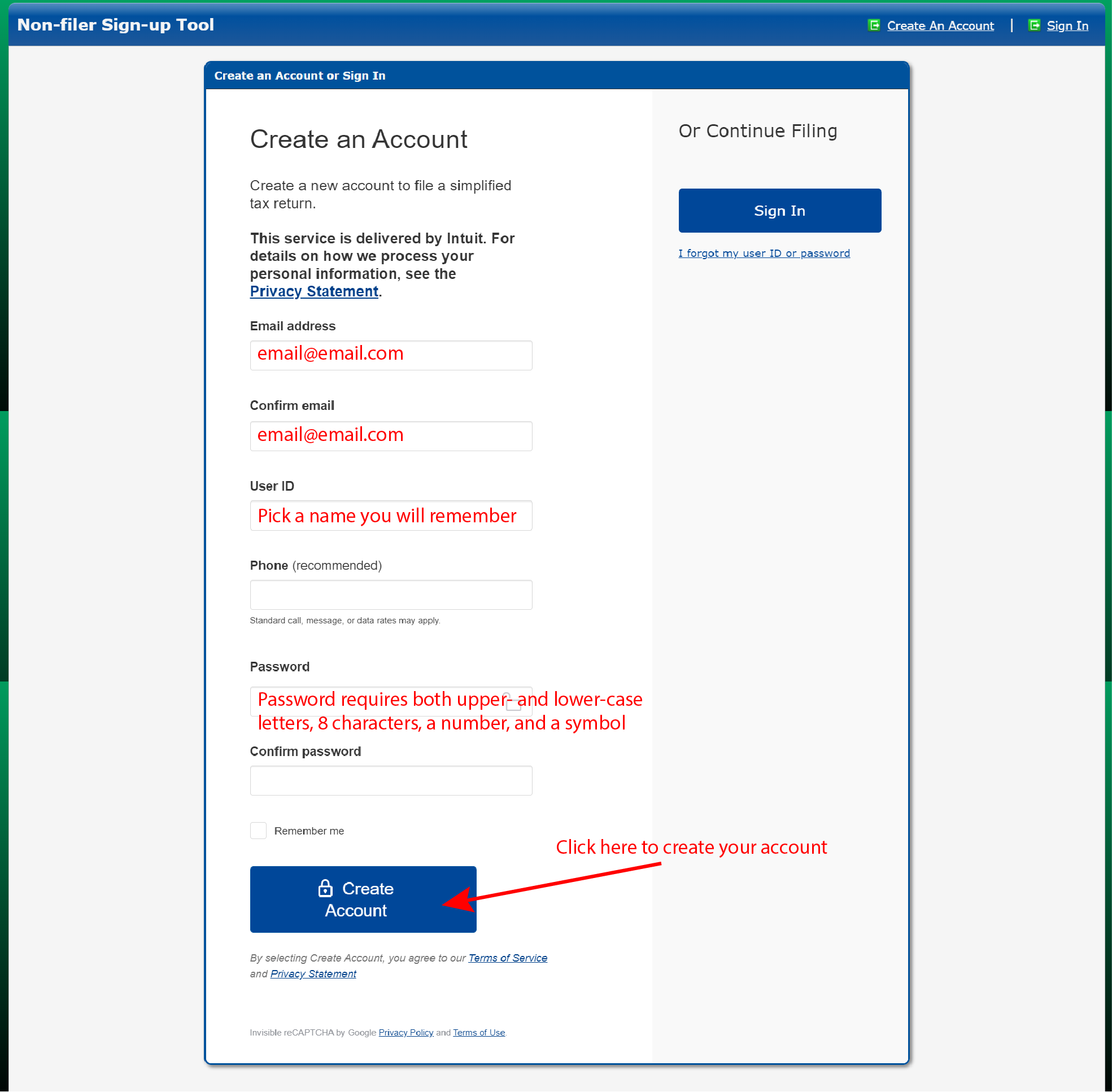

How To Fill Out The Irs Non Filer Form Get It Back

What To Do If You Re Late Filing Taxes Cbs8 Com

How Filing Tax Returns Late And Unpaid Taxes Affect Your Bankruptcy Case

Irs Tax Transcripts Financial Aid Office Suny Buffalo State College

Non Filing Of Us Income Tax Return 2011 2012 Academic

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

How To File Your 2021 Tax Return For Free Syracuse Com

Service Tax Return Due Date Penalty For Late Filing For Period April 16 To Sep 16 Simple Tax India

Why Teenagers Should File A Tax Return Money

What Happens If A Corporation Does Not File A Tax Return When It Owes No Taxes

October Tax Deadline Creeps Up On Millions Who Got An Extension

Tax Info For Non Resident Spouse Of Us Citizen Obtaining Green Card

3 11 3 Individual Income Tax Returns Internal Revenue Service

Irs Verification Of Non Filing Letter Download Printable Pdf Templateroller